Is there a place for property in DC default solutions?

17 Nov 2020

Initially, I wanted to start this blog post with a meaningful quote on property (or real estate) investing. Researching this led me to stumble upon hundreds of quotes, from ancient proverbs to famed investors to even ex-US presidents. Some were thought-provoking whilst others, I’ll be honest, I didn’t quite understand. This got me thinking about the premise of this post and how so much has changed since the COVID-19 outbreak. Recent times certainly haven’t been easy and as Gregory Peck* once said, ‘Tough times don’t last. Tough people do.’ A statement which has probably resonated with a lot of people this year and perhaps one which has also resonated with our pension investing. Market uncertainty can tend to do this.

I’ve read many articles too, ranging from member outcomes (yes this was a Hymans plug, but really, our Member Outcomes Tracker is great, have a read about it here) to the right types of equity my pension should hold to the need for diversification.

But one of the most widely reported impacts of COVID-19 on pension schemes has been the suspension of trading on property funds. Suspensions were put in place because valuers were unable to accurately value properties with any certainty due to a lack of transactions and operational activity due to COVID-19. By suspending trading, this prevented redeeming investors being paid out at inflated prices. This is the third time we have seen trading on property funds be suspended within the last decade, which highlights the uncertainty within the asset class. As for now, property funds have re-opened, but a key question still remains, ‘Is there a place for property in DC default solutions?’. Let’s explore this below.

Diversification

One of the main advantages of investing in property is the diversification benefits it offers against more traditional asset classes such as equities and bonds. Historic 10-year correlation figures can be seen in the table below:

|

Global equity |

Corporate Bonds |

FI Gilts |

|

|

Property |

-0.1 |

-0.2 |

-0.1 |

Source: Hymans Robertson as at 30 September 2020, indices used: MSCI World, MSCI UK Monthly Property Index, FTSE Gilts All Stocks

Performance

The return delivered by UK property has fallen over recent years. While much of this can be attributed to the uncertainties caused by seemingly perpetual uncertainty on Brexit and then COVID-19, some of the struggles are due to structural change. The retail sector has been severely impacted by the rise of online shopping, more so now due to various lockdown rules. The UK high street has certainly changed over the last decade and unfortunately this will continue as many stores are set to close their doors.

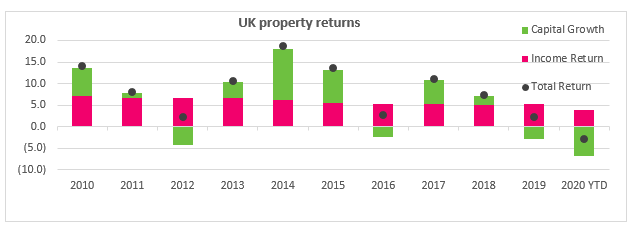

Over the last two years in particular, UK property funds have suffered from falling capital values and over the past year declining rental yields from these assets. The chart below shows UK property returns over the past decade, as measured by the MSCI UK Monthly Property Index (showing the total return as well as how this is split between the capital and income return).

Source: IPD UK monthly index, as at 30 September 2020

Total returns in 2020 so far have been -2.9%, with the income return of 4.0% mitigated by a -6.7% capital return. This drop in capital value was caused by the retail and office sectors. The latter could further impact returns more going forwards as flexible working may become the norm following lockdown. For me, personally, the new commute of around 1 minute compared to well over an hour has certainly had it perks. But whilst many of us may try to work from home more in the future to save on commuting costs and time, the knock-on effect would be whether firms need such large office spaces for perhaps 50% capacity. The chart shows that the 2020 return total return was the lowest of the decade. Note, the income return has been broadly consistent, as expected.

Cost

Property is an expensive asset class, both in terms of annual management fees and trading. Typical trading costs for UK property funds are 7-8% from point of purchase to point of sale. This prevents investors constantly changing managers, as costs will eat up returns. Furthermore, the high annual management fees can often lead to a less than optimal allocation, due to the DC charge cap for defaults, so its value may be limited. Property funds can also have additional layers of fees which incorporate transaction fees for the underlying property operations and purchases/sales, so investors are not always aware of the true running costs of property funds.

Increased regulatory burden

The suspensions have led many schemes to re-direct property contributions to cash funds. This in turn, has created an inadvertent default for Trust-based schemes and will increase reporting requirements for the Statement of Investment Principles and Chair’s Statement.

Illiquidity

There is a mismatch between the liquidity required of property funds and the illiquidity of the underlying properties that these funds invest in (it can take many months to buy and sell a property. DC schemes require daily-dealt vehicles for any asset class, however there is a mismatch between the illiquidity of property and the high liquidity required by DC investors (e.g. consolidation between pots or switching funds). This leads funds to hold lots of cash. While this is beneficial in down markets, it certainly dilutes overall returns in up markets. The below table shows the current levels of cash amongst common DC property funds.

|

Fund |

Allocation to cash (%) |

|

LGIM Managed Property |

14.5 |

|

Standard Life Pooled Property |

12.8 |

|

Aegon Property |

19.0 |

|

Threadneedle Property Fund |

11.0 |

Source: Investment managers, as at 30 June 2020

There is also a danger that if too many investors redeem at once then funds can be suspended again, and investors are then stuck and not able to withdraw or top-up. This is more significant if property is used in a default glidepath and members are then in an inappropriate asset allocation relative to their age or risk tolerance.

So, where does this leave us? Owning property has been seen as a good investment for centuries, the same message has been delivered through multiple sources, across many lands throughout history - there’s no wonder it was common market practice to involve property investing with our DC pension. And to be honest, despite the recent headwinds facing the asset class, UK property investing still has a lot of merit. It can provide significant diversification and an attractive return to investors over the longer-term, although expected returns over the next few years are likely to be muted compared to historical returns due to the changing retail landscape and uncertainty surrounding further lockdowns. As a result, we would urge schemes to consider the appropriateness of property allocation within their default glidepath. As for self-select ranges, there is still very much a place for UK property there as long as members are aware of the costs and illiquidity of the asset class.

*For those unfamiliar, Gregory Peck was a popular film star in 1940’s-1960’s and played one of my favourite literary characters of all time Atticus Finch.

0 comments on this post