A guest blog from Hymans Robertson Personal Wealth

5 steps to help overcome the cost of living crisis

01 Apr 2022

We have all seen the news about the cost-of-living crisis which is beginning to have a significant impact on all of us. The conflict in Ukraine, supply chain disruption and energy prices soaring have all contributed to the cost of living going up which has negatively impacted on the amount of disposable income we have available. Julie Hammerton did a great article a few months ago on three things that you can do to get on top of the cost of living crisis but I’d like to go a step further and give you some simple, yet effective, steps you can take to help minimise the negative effects of this current crisis.

In her article, Julie provided suggestions on how to get on top of your current expenditure through regularly budgeting. She also wrote about how scrapping subscriptions that you don’t use, planning your weekly food shop with an old-school shopping list and selling possessions that you no longer want or need online can help save you money. All these suggestions are useful but given the current strain on many households, we wanted to give you some additional tips to help make an even bigger impact. Please find below some steps that you can take to help manage your expenditure:

1.) Look to reduce your energy bill.

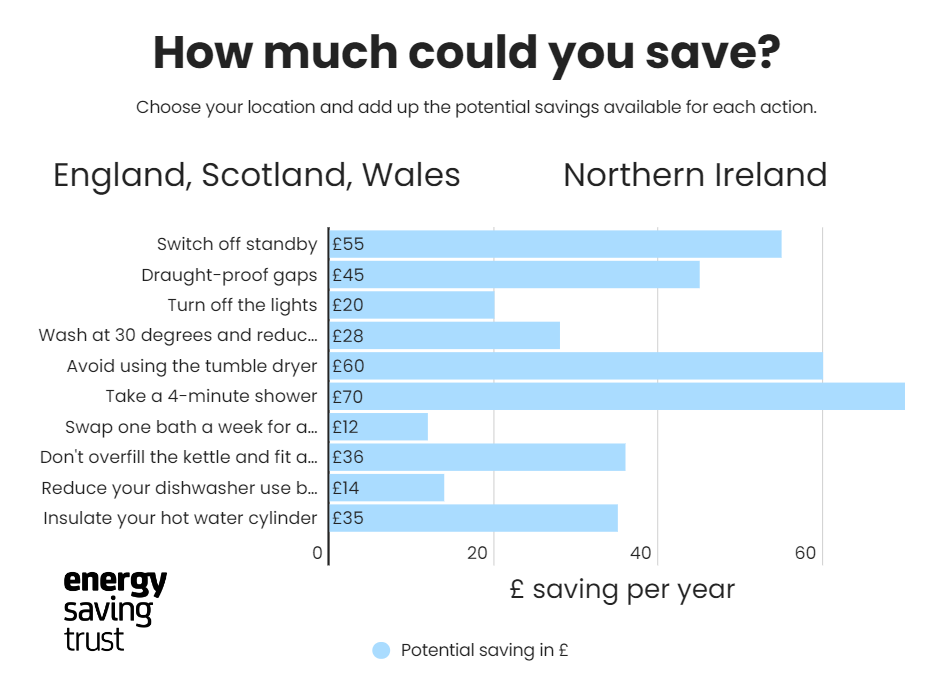

With energy prices having gone up significantly since 1st April, it is vitally important to try to make your energy consumption as efficient as possible. The EnergySavingTrust has done some great research and has compiled the table below which demonstrates how much you could save on your energy bill by making some simple lifestyle changes throughout the year. Taking a shorter shower, avoiding the tumble dryer and switching appliances off stand-by have the biggest potential for savings.

*Savings are for a typical three-bedroom, gas-heated home in Great Britain, using a gas price of 7.4p/kWh and electricity price 28.3p/kWh (based on April 20222 price cap). Water savings are based on average occupancy. This household is projected to spend a total 1,970 on energy annually, including standing charge. Figures update March 2022.

Source: Energy Saving Trust Quick tips to save energy at home - Energy Saving Trust 27/04/2022

2.) Look to reduce food waste as much as you can.

According to Olio, the mobile food-sharing app, the average family in the UK throws away a staggering 22% of their weekly food shop which equates to £730 per year! By making a shopping list and diary planning every time you go to the supermarket you can save yourself a significant amount of money. You can also help to reduce your food waste by clearly knowing the difference between ‘use-by’ and ‘sell-by’ dates. If a product goes past the ‘sell-by’ date, it is usually fine to eat. If you are unsure, then conduct a ‘sniff’ test - if the food is spoiled it will smell bad and needs to be thrown away. Alongside the app OLIO which is free to use, there is also another app called Too Good to Go which helps pair households with food from restaurants/cafes, shops, supermarkets and other homes that are either unable to sell food items or don’t want to waste perfectly good food – apps like these can also be a good way to reduce your food waste and can save you money!

3.) Search for the best fuel price.

With the price of fuel increasing, look to get the best price in your local area with comparison tools like Confused.com Petrol Price Comparison Tool which helps you search your local petrol stations and their fuel prices. By using this tool, you can ensure that you are always getting the best deal with it comes to filling up at the pump. When it comes to long car journeys, try to plan ahead and avoid paying for fuel at motorway service stations as they usually charge an additional premium.

4.) Avoid using convenience stores.

I am always quite shocked at how much going to my local convenience store can be for the odd item. By ensuring that you plan your meals in advance you can significantly reduce the number of trips you need to take to your local Tesco Express, Sainsburys Local or Co-Op which will save you money in the long run.

5.) Adopt a 24-hour rule for discretionary purchases.

Before making a discretionary purchase ensure that you give yourself 24 hours before completing the transaction to give you sufficient time to reflect on whether you really need the item or whether you can make-do without it. It may be a good idea to remove any pre-input card details from any online companies to put an added barrier in place and make you have to ‘think’ before parting with your money.

We know it is a difficult time for a lot of people in the UK right now with living standards taking a significant drop which is forcing people to make uncomfortable decision when it comes to day-to-day living. If you have any questions or would like more details on how you can better manage the rise of the cost of living then please do get in contact, we’d love to help!

The information here is for general information purposes only and should not be regarded as financial advice. It should not be considered a substitute for regulated advice on specific circumstances and objectives.

Find out more about Hymans Robertson Personal Wealth here.

0 comments on this post