Integrated risk management

The impact of Covid-19 on LGPS ill health retirement costs

30 Jun 2022

As LGPS funds review risk policy and set funding strategies as part of the 2022 valuations, we examine the impact the pandemic has had on ill health early retirement risk, including analysing recent experience trends and future outlook.

Initial observations on experience trends

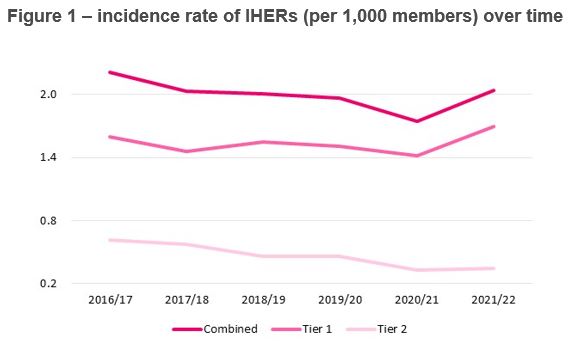

We’re all sadly familiar with the impact the pandemic has had on our lives and loved ones over the last two years. In those initial days of Spring 2020 we witnessed the acute phase when the NHS had to prioritise treatment of COVID-19 patients. Unfortunately, we continue to experience backlogs from cancellations of routine appointments, diagnosis and scheduled treatment. Emerging data1 from LGPS Funds in Figure 1 below allows us to consider if Covid-19, and this pressure on the NHS, has had an impact on LGPS ill health early retirements (IHERs).

Figure 1 – incidence rate of IHERs (per 1,000 members) over time

The data shows there has been a reduction in the number of IHERs over the initial period of the pandemic covering 2020/21. This may have been caused by a variety of factors, for example, delays in individuals accessing medical assessment, prolonged isolation to avoid Covid-19 or not considering ill health retirement while on full or partial furlough. Logistical difficulties for employers in accessing and processing IHERs whilst navigating business difficulties is sure to have also had some impact. The data also shows a clear increase in IHERs into 2021/22, perhaps due to a catch up of delayed cases or the impact of already poorly individuals contracting Covid-19. Should this trend continue, we would expect increasing costs and risk for LGPS funds and employers.

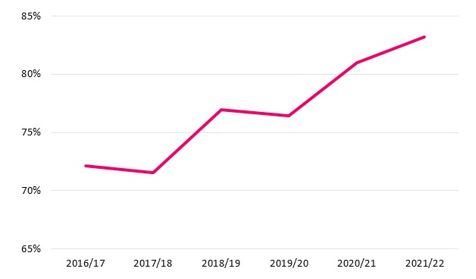

Figure 2 below shows an increasing proportion of the more severe Tier 1 IHERs (see the LGPS member website for a more details on the tiers of IHER in the LGPS). Again, this may directly reflect the worsening health outcomes members are experiencing due to delays in seeking and obtaining treatment or contracting Covid-19. Should this trend continue, we would expect increasing strain costs due to the higher additional service awarded for Tier 1 versus Tier 2.

Figure 2 – proportion of strain costs which are Tier 1

The data also shows that there has been an increase in the number of “large” strain costs, with strains costing employers over £1 million becoming more common. It is this uncertainty and exposure to large strain costs that can severely impact an LGPS employer’s business.

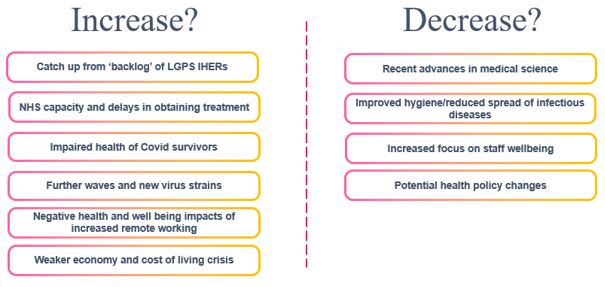

The future outlook

There is no consensus on the longer-term impact of the pandemic on morbidity but it’s clear that the future outlook is more uncertain. The graphic below highlights some areas which could increase or decrease the cost and risk of IHERs in the LGPS:

The importance of risk management policy and action

IHER risks have increased as a result of the pandemic and the ensuing “cost of living” crisis. This may mean that many LGPS employers could be left exposed by ineffective risk management and policy.

IHER risks are made worse by the increasing cost pressures on LGPS employers, at a time of depleted reserves following the last two years. Many employers can therefore not afford the potentially catastrophic implications of a large IHER of one or more of their staff.

We strongly recommend that LGPS funds consider and review their ill health risk management policy as part of the 2022 Valuation and Funding Strategy Statement review. A variety of solutions are available and in widespread use across the LGPS, including internal pooling, external insurance or a hybrid of the two.

1Provisional 2022 data taken from a range of LGPS funds across the UK.

0 comments on this post