Longer working lives and much higher contributions needed to reach latest Retirement Living Standards

19 Feb 2024

Most people will now have to work longer, or be able to afford much higher pension contributions, to maintain the same level of the PLSA’s Retirement Living Standards (RLS), according to Hymans Robertson’s analysis of the PLSA’s updated figures. The leading pensions and financial services consultancy analysed how different combinations of contribution rate and salary impact the chance of achieving the latest RLS, following the PLSA’s announcement that double-digit increases in annual retirement income are needed this year to achieve Minimum, Moderate, and Comfortable standards of living. The firm warns that trustees, providers, and employers must communicate clearly with members, encouraging them to set, and monitor their progress against, their retirement income target.

According to the PLSA, an individual will now need £31,300 p.a. for a Moderate standard of living, up by 34%. For average earners, Hymans Robertson calculates that contributions of more than 16% p.a. are required to have a reasonable chance of achieving the Moderate standard. Even for high earners, simply paying the 8% minimum total contribution rate under auto-enrolment is unlikely to achieve the Moderate standard.

For a Comfortable standard of living, £43,100 p.a. is now needed, up 16% from last year. For those earning a salary of £50k p.a., the analysis has shown that a total contribution rate of more than 18% p.a. would be required to achieve this Comfortable standard, which is out of reach for most members.

For a Minimum standard of living, £14,400 p.a. is now needed, up 13% from last year, though most members who will receive the full State Pension are likely to achieve the Minimum standard. The State Pension remains a significant component of retirement provision for low earners, and members should understand their entitlement. A realistic target for low earners is likely to lie somewhere between the Minimum and Moderate standards.

Hymans Robertson’s projections are based on its Guided Outcomes (GO)TM Model, which calculates future retirement incomes by considering member specific characteristics such as age, salary, contribution rate, current fund value, assumed investment choice and retirement age.

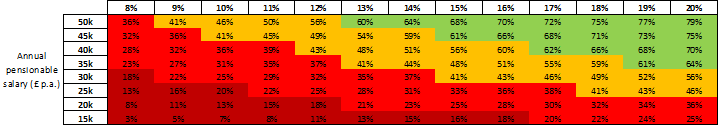

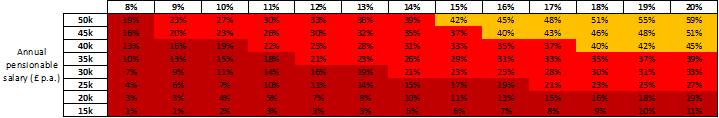

The results are categorised using a colour scale of red (unlikely to achieve the standard), amber (moderate likelihood), and green (likely to achieve the standard):

Moderate (£31.3k p.a.)

Comfortable (£43.1k p.a.)

Commenting on the findings, Darren Baillie, Head of Digital Strategy for DC Pensions, Hymans Robertson, says:

“The hill that members need to climb to achieve their desired retirement outcome has become shockingly steeper in the last year, partly due to the cost-of-living crisis. Plugging the savings gap through higher contributions alone is impossible for most people, so to meet the new standards, people will need to work for longer. Our analysis shows that a member in their mid-50s, who was on track to achieve the Moderate standard before the cost-of-living crisis, would now need to defer retirement by one to two years to achieve the same outcome.

“Trustees, providers, and employers need to take several actions to help members understand their pension adequacy and make informed decisions about their retirement. Firstly, they must help members set a retirement income target. This can be an effective way of improving engagement and the RLS provide a useful framework for deriving targets that can be tailored to members’ spending patterns. Secondly, they must help members find and understand their State Pension entitlement and what it means for the personal pension savings they’ll need for retirement. Finally, they must provide members with the means to monitor progress against their target and understand what changes they can make to improve their outcome.

“These actions should be in addition to the pensions industry promoting ways to help members extract more value from their DC savings, in response to the FCA’s highlighting of the lack of product innovation. Alternative design options such as longevity pooling could help older members, who have little time to make up the savings gap. Entering a longevity pool could allow members to achieve their desired standard of living without having to defer their retirement or significantly increase their contributions.

“It’s also vital that the Government does more to help. This should include an overhaul of the current auto-enrolment legislation and an increase in the AE minimum total rate to 12%.”

A copy of the Helping Members Achieve Retirement Goals – February 2024 report can be found here.

0 comments on this post