Sixty Second Summary

RPI reform

26 Nov 2020

The results of the Consultation on the reform of the Retail Price Index (RPI) were announced on 25th November 2020. It confirms that RPI will be aligned with CPIH as proposed, but not before 2030 and no compensation is being offered to index-linked gilt holders.

Following our recent publication outlining the main issues relating to proposals to reform RPI, the Consultation results just announced remove most of the uncertainty about the future of RPI. The key points are:

- RPI will be aligned to CPIH

- The change is expected to occur in 2030

- No compensation is being offered to holders of index-linked gilts

Implications for pension schemes

Aligning RPI to CPIH is expected to reduce the rate of inflation linked to assets and liabilities that reference RPI. However, the impact on a pension scheme’s funding level depends on the value of liabilities that are linked to RPI and the proportion of those liabilities backed by RPI-linked assets. The difference between RPI and CPIH is significant and historically has been in the region of 1% pa. This has a material impact on long dated RPI-linked assets and liabilities.

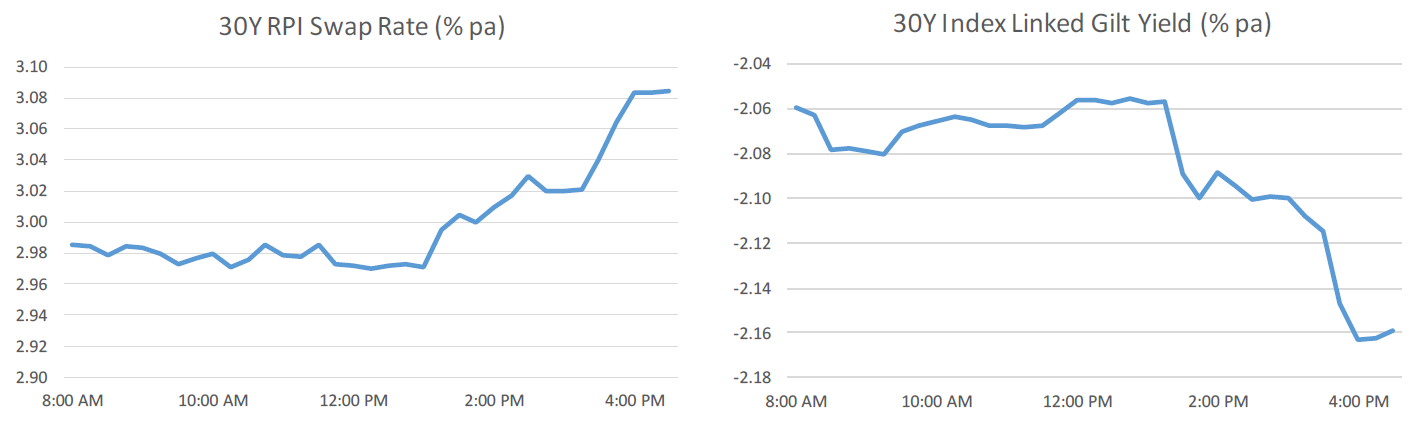

In anticipation of this outcome, liabilities and assets linked to RPI had already been re-pricing downwards, and we expected a further fall in value given the announcement (ignoring changes in interest rates and other factors), though early indications are that the market reaction has been fairly muted and in the opposite direction. This suggests that the market may have already been close to fully pricing in the outcome and other factors at the margin caused a modest re-pricing upwards. The charts below show the market levels during the day of the announcement, sourced from Bloomberg.

Even though some schemes may not be materially affected or could even benefit financially from this development, pensioners with RPI-linked pension increases should expect to see their pension incomes grow at a slower rate as a result.

Our view

We were one of the respondents to this Consultation and urged the authorities to consider how best to implement such a change in order to minimise the many issues that this creates. One of our biggest disappointments is that on the one hand pension schemes are encouraged to invest prudently and on the other hand some of them will be penalised by this change.

There are however some positive aspects to the announcement:

- It brings clarity to the problem of RPI

- Pushing the implementation date back to 2030 at least reduces the impact, when there was a possibility that the implementation date could have been set as early as 2025

- The Consultation responses seem to have been properly considered and it was acknowledged that a large number of respondents were against the change and some pension schemes would be negatively impacted

- The Government stated it will continue to keep this matter under review given the number of responses from pension schemes, which may give some a glimmer of hope that further developments are possible between now and 2030

Although we do not agree that this has been the best way to reform RPI, we are grateful to our clients who took the trouble to engage in this matter and respond to the Consultation.

Next steps

For many pension schemes, there may not be any immediate actions to take as a result.

A small number of schemes may have taken some action over the past year or two when uncertainty about RPI started to resurface. This may have included adjusting their inflation hedging programme. These programmes should now be reviewed in the light of this announcement.

Schemes invested in Network Rail bonds should also review these holdings as investors in these bonds have different legal protections against changes in RPI compared with index-linked gilts. There is an expectation that Network Rail bonds are likely to be compensated for changes in RPI, however, this has not been legally proven so holders of these bonds (and prospective buyers) should consider whether the yields currently on offer from these bonds fairly reflect the balance of likelihoods between the potential for full compensation and the risk that this does not materialise as expected.

On liability valuations, there will be implications for inflation assumptions used across funding, accounting and member option terms (such as transfer values). In particular, with assumptions for CPI typically set as RPI less a fixed deduction, revisions are likely to be needed to ensure the RPI-CPI wedge remains reasonable if these have not yet been adjusted. Schemes should take note of whether revised assumptions for future RPI levels are fully allowed for in liability valuations for ongoing monitoring.

0 comments on this post