Public Sector

Infrastructure – Future Prospects

19 Apr 2022

Infrastructure is a “natural” asset choice for long-term investors looking for a steady stream of cashflows, so it is not surprising that the asset class has attracted institutional capital for many years. The volume of capital deployed has increased over time, but not as quickly as many expected or hoped. The reality is that it takes a long time to originate new infrastructure assets: the bespoke nature of infrastructure assets, the complexity of infrastructure projects and the cumbersome nature of planning processes in many jurisdictions are three key reasons why this is the case. Originating suitable assets is likely to remain a challenge, leading some to fear that the capital currently being committed will take too long be deployed or that investors will compete too aggressively for assets, driving returns down to unattractive levels.

This article provides an update on recent developments and future prospects for infrastructure and considers the continued strength of the investment case.

Diverse opportunity set

Infrastructure is commonly defined as the set of facilities and essential services required for the effective functioning of modern economies. Behind this simple definition lies an asset class of considerable diversity; this makes it challenging to evaluate infrastructure opportunities but also underpins the diversification potential of this asset class.

Infrastructure opportunities can be differentiated in several ways as shown in the graphic below:

![]()

Market size and growth

Worldwide most infrastructure is in public ownership although private companies are typically involved in developing and sometimes operating the assets. The UK is unusual in this respect; it began privatising existing infrastructure and developing new assets through public-private partnerships much earlier than most other countries. The UK now has a high proportion of privately owned and operated infrastructure, underpinned by robust regulatory and legal frameworks and a relatively deep secondary market.

The available market data focuses on transactions in private assets. Global transaction volumes were down in 2020/21 but fluctuated between USD 250-350bn of enterprise value1 in the preceding 5 years. Over the same period, the volume of capital raised globally increased from USD 80-120bn bn p.a. before flattening off during the pandemic2.

Most countries do not invest enough in infrastructure, given the key role it plays in facilitating economic growth and in the equitable distribution of wealth. In many, key infrastructure is over-used, needs upgrading or is simply not available. At the same time, there is strong demand from institutional investors to increase allocations to the asset class. So why has the market not grown more quickly and what are the prospects for future growth?

Infrastructure projects are challenging to deliver; they typically involve high capital expenditure, take years to develop and decades to achieve the full return on investment. Hence, the market has a slow and steady rate of natural growth but there are a number of reasons to be optimistic about the prospects for the asset class.

- Governments are showing greater awareness of the socio-economic costs of sluggish productivity growth and wealth inequalities and the role high quality infrastructure can play in addressing them.

- The pandemic and heightened geopolitical risks have highlighted the need for more resilient supply chains which will also involve increased investment in infrastructure.

- The single most important driver of growth will be decarbonisation - achieving net-zero will require massive investment across all segments of the economy.

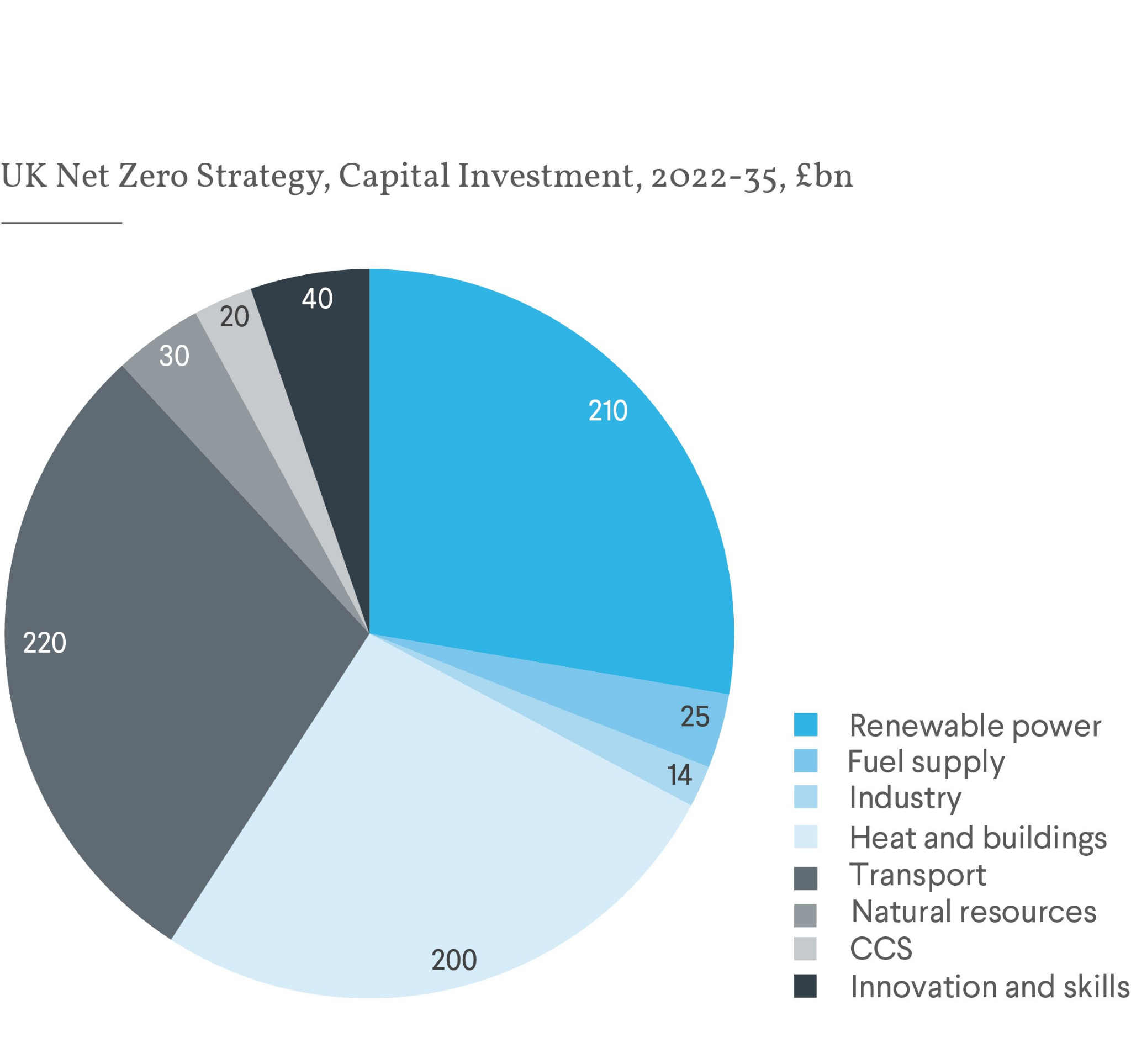

In the UK, for example, the government’s net zero strategy calls for £695-825bn of public and private sector capital to be mobilised over the period 2022-2035 (£45-55bn per annum), much of which will be invested in enabling infrastructure (see chart below)3. Investment will be required across many sectors including renewable power generation (solar, wind, hydro/tidal etc), energy storage (e.g., large-scale battery facilities), green fuels (e.g., hydrogen), transportation (e.g., electric vehicle charging networks), carbon capture and storage, and others. Opportunities will also arise to invest in companies support the energy transition.

Similar projections were provided by the UK’s National Infrastructure Commission in its first infrastructure assessment report. It estimated that public investment of c1.2% GDP (£27-29bn per annum), matched by a similar amount of private capital, would be required to fund national infrastructure requirements over the 2020s4.

Other key trends

Institutional investment in infrastructure has been dominated by three key trends over the last decade:

- Increasing importance of renewable energy and digital infrastructure

- Greater understanding and tolerance of risk

- Development of new origination channels.

In 2010, renewable energy projects such as offshore windfarms and biomass/energy from waste plants were considered niche investments. Now they dominate deal pipelines alongside investments in digital infrastructure including data centres, fibre broadband and 4G/5G mobile networks. Generous government subsidies played a key role in stimulating the supply of private capital and improving technologies. Such policies have been so successful that today renewable energy projects in developed markets are viable without government support and are generally considered to be low risk. As a result, investors have invested heavily in the sector and returns have come down. To achieve similar returns, investors have had to accept more risk.

Institutional investors now routinely invest in:

- Technologies, such as battery storage systems, which are technically mature but not commercially proven at scale

- Operating businesses, such as airports and train operating companies, rather than just the underlying infrastructure assets

- Jurisdictions with increased political, regulatory and legal risks

- Assets under development as well as those in operation.

At the same time, we have also seen a trend towards infrastructure managers offering new funds focusing on lower risk, core or super-core assets.

Originating high quality assets has been a perennial challenge in infrastructure. Over the last decade, institutions have increasingly taken two approaches to addressing this issue: (1) developing new assets themselves or committing capital to third-party development platforms and (2) exploring alternative sources of existing assets. In the past, investors relied on privatisation programmes and thin secondary markets as the primary means of acquiring existing assets. Privatisation is less popular than it once was in many countries, but there has been a significant increase in the divestment of infrastructure assets by major utility companies and other corporate seeking to optimise their balance sheets over the last decade. Secondary market trading has increased dramatically, and we are also seeing a rise in take-private transactions of listed companies.

Implications for investors

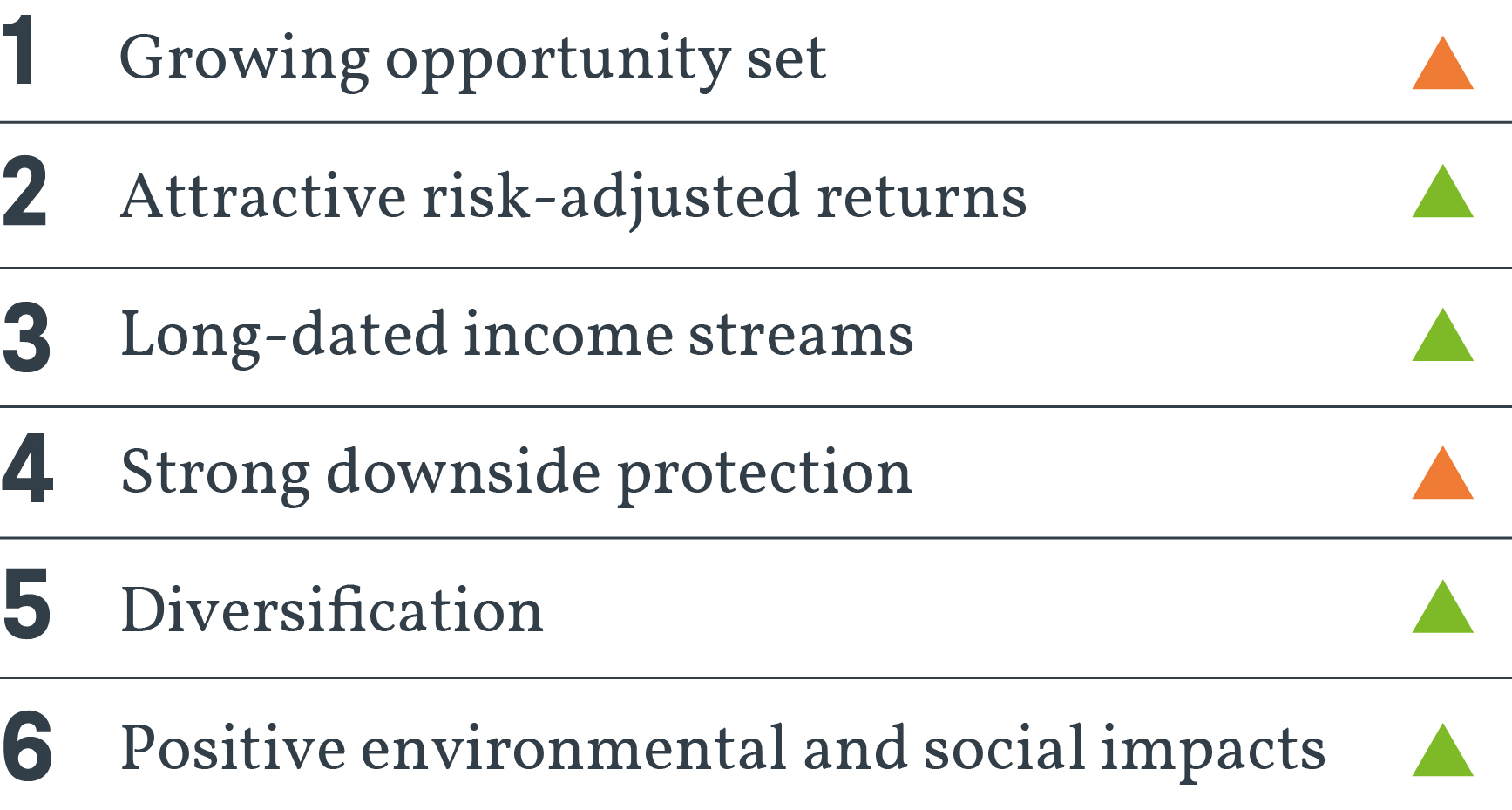

The investment case for infrastructure depends on six key elements, as illustrated below.

The diagram also summarises our assessment of the continued validity of each element using the following scale: no major concerns (Green), issues to be addressed (Amber), major obstacles to successful investment (Red).

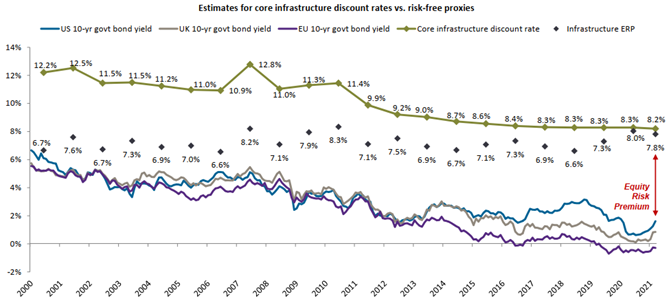

Headline returns in infrastructure have fallen since the Global Financial Crisis as the asset class became more established and new investors entered the market, but the premium received by investors for taking infrastructure risk (measured by the difference between the yields on infrastructure assets and sovereign bonds) has remained remarkably stable5 (shown in chart below).

Stabilised operational infrastructure assets (that would usually be categorised as core/core-plus) continue to offer attractive income yields which often have an implicit and sometimes a contractual linkage to inflation.

As noted above, there is evidence that some sponsors are taking more risk to maintain headline returns. But even higher risk infrastructure often benefits from strong downside protection including; involvement in the provision of essential public services, regulated monopoly positions, contracted revenue and a focus on proven technologies.

Conclusion

Although the nature of the underlying assets has evolved over recent years, the investment case for infrastructure remains strong. Capital deployment remains a challenge and effective risk management is more important than ever, but we believe infrastructure can still add value as a diversifier and long-term enhanced income asset within a wider investment portfolio. Given the large investment required to meet the UK’s net zero targets, an investment in infrastructure in the current market cycle could also have strong environmental and social impacts.

Infrastructure projects are challenging to deliver; they typically involve high capital expenditure, take years to develop and decades to achieve the full return on investment. Hence, the market has a slow and steady rate of natural growth but there are a number of reasons to be optimistic about the prospects for the asset class.

1Source: JP Morgan analysis (using Preqin data)

2Source: Infrastructure Investor

3Net Zero Strategy; Build Back Greener, HM Government, October 2021

4First National Infrastructure Assessment, NIC, July 2018

5Source: JP Morgan

0 comments on this post