2019 Valuation Reflections

06 May 2020

The end of a LGPS valuation always invites a time for reflection over the past year and, for those of us who have been around a while, a comparison to previous exercises. In this note, we look back to valuations of the past and reflect on how life has changed for us all and what the future may hold.

What did valuations look like 40 years ago?

1980 was the year of John Lennon’s assassination in New York, the introduction of Post-It notes and the release of Pac-Man…and it was also a valuation year in the LGPS. We recently wiped the dust off of an actuarial valuation report from 1980, published by the then Robertson, Hymans & Co. On first glance it’s an almost humorous read, as a number of very stark differences between 1980 and today jump out. A world where the average full time equivalent salary of an active member was just £4,260, interest rates were 17% p.a. and the actuary signed off the report with “Your obedient servant” seems very far removed from today.

A number of things have changed since 1980: the scheme is far more complex today, with 3 tranches of benefits to administer (plus a 50:50 scheme), more regulation to comply with and thousands of different

employers all with their own unique funding objectives. The beneficiaries of the LGPS themselves have changed, and are now expected to live almost a decade longer than their 1980s predecessors.

However, as one of our wiser (and more mature) colleagues explains, whilst the world back then looked very different, there are some things that have

not changed:

- The LGPS as a whole still has a strong covenant, and funds continue to invest in largely growth seeking portfolios (although the portfolios of today are far more sophisticated).

- These growth-oriented portfolios can be highly volatile in the short term, but it has always been, and continues to be, Hymans Robertson’s view that it is important to take a long-term view when funding long term benefits, rather than making knee-jerk reactions to short-term “noise”.

- Managing funding surpluses appropriately is just as important as making good deficits. In an even more historic LGPS valuation report from 1959, the actuary recommended that some of the funding surplus identified should be retained to act as a buffer against future headwinds instead of funding a significant reduction in contribution rates.

Today’s valuations

Fast forward to today and we now live in a world where we have the ability to individually tailor funding plans to a wide range of individual circumstances and objectives. Here are some of the things LGPS funds have been considering during the valuation exercise in 2019.

Understanding the “what ifs”?

First introduced for the 2010 valuations, Asset Liability Modelling is more powerful than ever before. At the touch of a button, we can now answer questions such as “Does this contribution strategy work if I reduce investment risk by 20%?”, “What happens if my asset value drops by 10% overnight?” and even “How might my funding level be affected in the face of adverse

climate change scenarios?”.

Individually tailored investment strategies

In today’s LGPS there are a variety of employers with different funding profiles, covenants and funding objectives, which cannot all be best served by a single investment strategy. At the 2019 valuations, we set contribution strategies for funds who have up to four different investment strategies in operation.

Effectively managing exits

Many LGPS employers have a desire to leave the scheme but not the cash required to meet what can often be a significant exit payment. We have worked with funds to put in place exit plans which have allowed employers to cease participation in an affordable way, without jeopardising the security of members’ benefits or their jobs.

Looking ahead

At Hymans Robertson, we are always thinking about the future and striving to do better for the LGPS. We have already commenced work in preparation for the next round of valuations in 2022, with focus in the following key areas.

Measuring data quality

Good quality data is the foundation of a successful valuation. We developed our Data Portal in 2016 to help you validate your membership data in real time, and in 2019 this functionality was extended to your cashflow data.

With the strides recently made in ‘data science’ we are reviewing how the Data Portal carries out its validations and reports them back to users. Being able to help you easily identify employers and/or data fields with the highest concentration of errors is one of the main aims. We are also developing reporting tools to help you understand how your data quality is evolving over time and identify areas for improvement.

More power to you

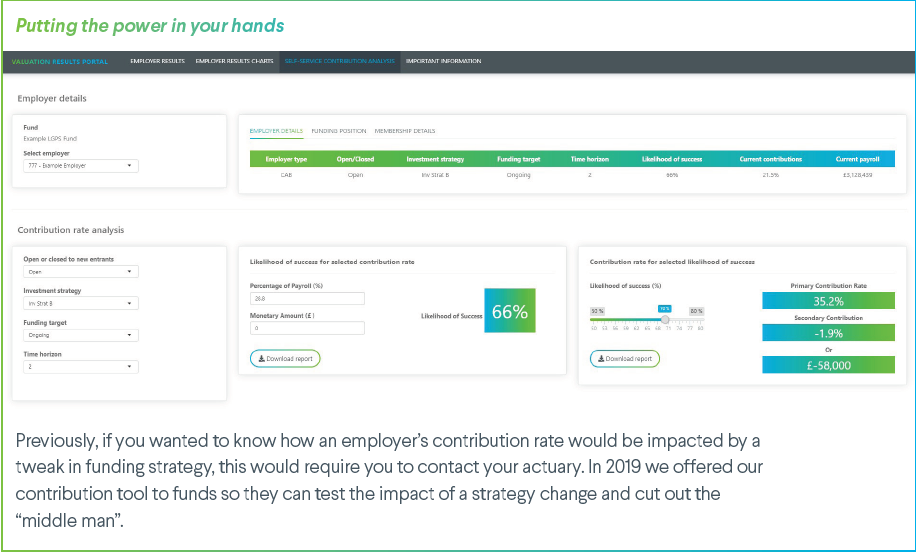

We will continue to invest in our systems that are used to carry out your actuarial valuation with the purpose of delivering quality results, leaving you more time to focus on the important stuff.

Alongside this, for 2022 we will develop the valuation results portal to allow you to create employer and pool results schedules. This is another step towards our ultimate aim of providing self-service valuations on demand.

Greater understanding of risk

In 2016 we expanded our risk-based funding approach to all employers. For the first time, you were able to set every employer’s funding plan with an understanding of the underlying risk. You can now answer questions like: “How likely is it that this plan will work?” and “How bad could things get if the future is worse than we expect?”. Recent market upheaval resulting from the COVID-19 pandemic has highlighted just how important it is to understand how your funding plan will play out under a wide range of future market

conditions.

For 2022 we are looking at how to further improve the understanding and reporting of risk in funding plans, especially around the measurement of past service funding positions. Helping you and your employers better understand funding risk is a key factor in ensuring the LGPS continues to be a successful pension scheme in the future.

If you would like any more information about what we have discussed, please contact your usual Hymans Robertson contact.

0 comments on this post