BLOG

Bermuda Monetary Authority proposed enhancements to the Regulatory Regime - Key points and Implications

03 Apr 2023

On 24 February 2023, the Bermuda Monetary Authority (“BMA”) published its consultation on enhancements to the regulatory and supervisory regime for insurers in Bermuda. The main changes, which could be material for some firms, impact life insurers. Below we discuss the key points and implications.

Overview

(Re)insurers are being asked to “field-test” the proposals using bases specified in a template published by the BMA. The deadline for responding to this consultation and submitting field-test results is 30 April.

A second version of the consultation paper is scheduled for Q3 2023 with a second round of field-testing. The draft bill, revised draft rules and guidance notes are expected to accompany the second consultation paper, with the BMA intending that the new requirements will enter into force on 1 January 2024.

With the consultation document running to 72 pages, there is a lot of information to digest. We’ve summarised the key areas of change below:

- Technical Provisions (“TPs”) – specifically relating to the Scenario-Based Approach (“SBA”) discount rate. The requirements will become more like those of the Matching Adjustment (MA) in the UK and Europe. It is also proposed that the risk margin for an insurance group is equal to the sum of the entity risk margins.

- Bermuda Solvency Capital Requirements (“BSCR”) –introducing new expense and lapse risk sub modules which refine the capital charges for these risks, making them more risk sensitive. For non-life (re)insurers there is a refinement and clarification of the capital charges for man-made risks.

- Company Specific Parameters (Section 6D) – there will be greater justification, governance and oversight on the use of company specific parameters that some firms use to adjust the standard model capital requirements calculation. For more complex adjustments, the requirements become much more aligned to the requirements of (partial) internal models used in the UK.

- Regulatory fees are expected to increase to reflect the increased cost of regulatory supervision in light of these proposals.

Below we have set out what we consider to be the most pertinent points for (re)insurers instead of attempting to replicate the detail in the consultation paper.

Technical provision enhancements: The Scenario-Based Approach

The BMA’s proposed changes would go some way to aligning the SBA requirements to those surrounding the Matching Adjustment in the UK and Europe. Below we note some of the key changes that would be introduced by proposals if implemented as drafted:

Regulatory Approval: Firms would require prior regulatory approval before using the SBA (in addition to approval to use assets which are admissible on a limited basis). Those already using the SBA will require approval for all incremental new business (including new tranches of flow reinsurance). Those who are not currently using the SBA (and any new (re)insurers) will need to obtain approval.

The application process is likely to be onerous and will look at all aspects of the SBA including the calculations, the models used and the key assumptions underpinning these, stress-testing (including the newly prescribed lapse and market stresses), liquidity management processes, the quality of governance and documentation, the data required and model risk. The approval process is also expected to scrutinise any external dependencies, the robustness of the firm’s systems and infrastructure and adequacy of the firm’s skills and resourcing. This is likely to be a more onerous requirement than most Bermudan firms are currently used to when compared to, say, the company/group specific parameter approvals.

The proposed new regulations will require the following:

- No material lapse risk: insurers will need to demonstrate that the (re)insurance obligations either include no lapse option for the policyholder; or where these options exist, the residual risk is not significant. It will no longer be possible to apply the SBA to business with material lapse risk. This will mean that certain liabilities currently included by firms in the SBA will be disallowed, particularly variable annuity type products with significant optionality.

- No splitting liabilities: It will not be possible to split liabilities to make one part SBA eligible.

- Ring-fencing assets: Assets separately identified as backing the SBA will not be able to be used for any other purpose. This will present new operational challenges for firms as these are not typically separated at present and are, in some firms, considered fungible/transferable.

- Asset-related requirements: there are a number of asset-related considerations set out in the consultation paper. Each of these will require changes to the SBA calculation and may reduce the SBA benefit. For example:

- assets with optionality will receive particular scrutiny and may not be SBA eligible in some cases.

- firms should not assume that illiquid assets can be sold at NAV under stress to meet cashflow requirements - extra liquid assets will need to be held instead.

- The illiquidity premium will be determined based on assets held, so firms will not be able to take a “repositioning benefit” by recognising the returns on assets they could switch into rather than those held in portfolios.

-

Regulatory default and downgrade cost assumptions: A new feature of the SBA will be that the BMA will specify default and downgrade assumptions – much like the PRA does for the Fundamental Spread in the context of the MA in the UK. To the extent that these new regulatory assumptions differ from the firm’s own view, there will be a (likely adverse) impact on the balance sheet. Where the BMA’s prescribed assumptions aren’t appropriate for an asset, the onus will be on firms to demonstrate appropriate probability of default and cost of downgrade assumptions.

-

Liquidity management framework: As part of the enhancements to the SBA, the BMA is seeking to introduce a requirement for insurers to implement a Liquidity Risk Management programme. This would cover developing a Governance and Risk appetite, developing a cash needs and sources register, setting out an explicit liquidity buffer, undertaking stress and scenario testing, setting out a liquidity contingency plan and developing comprehensive monitoring and reporting mechanisms. This is more detailed than most Bermudan firms currently have in place.

-

Data requirements: There is a renewed focus on ensuring data used in the calculation of the SBA is accurate, complete, appropriate and processed sensibly and external data is fully understood. Insurers will need to ensure that they have an approved data policy in place and document processes and procedures.

-

Model governance: The SBA will require enhanced approaches to model governance including ensuring proper model validation, governance and board sign-offs. Model risk management will also need to be reviewed including maintenance of model inventory, validation and calibration. We expect that the current suite of tools used for SBA calculations will need to be improved, in particular with respect to the level of controls, oversight and model governance – all of which are moving towards those for Solvency II internal model recognition.

-

Accountability and Attestations: The BMA will seek written attestations from the Chief Risk Officer as to the adequacy and independence of their line 2 challenge and level of oversight provided. They will also seek written attestation from the Chief Internal Auditor that the activities by both line 1 and line 2 provide adequate assurance that the principles and requirements of the BMA’s Guidance Note regarding the application of the SBA are fully met. These new requirements will increase the burden and responsibility on those needing to attest and could lengthen governance timetables.

The consultation also provided clarifications on practices that insurers must “stop forthwith” while reminding the approved actuary and other officers of the company of their fiduciary duties and “to evidence their satisfactory fulfilment of this fiduciary duty”

Technical provision enhancements: Other

Standard Euro discount rate: Firms would be allowed to use the EIOPA EUR curve (instead of the BMA’s Euro curve) to determine EUR liabilities without seeking approval from the BMA. The curves are not materially different and the BMA will consider whether to continue publishing a separate EUR curve in future.

Risk Margin for insurance groups: The proposals would require the risk margin of Insurance Groups to be calculated on an unconsolidated basis i.e. the group’s risk margin will be the sum of legal entity risk margins and there would be no diversification of risk margins between different entities within the group.

Bermuda Solvency Capital Requirement

The Bermuda Solvency Capital Requirement (BSCR) proposals concern changes to the ‘other long-term insurance risk capital charge’ to increase its risk sensitivity for lapse and expense risks. Changes are also proposed to be made to Property and Casualty (P&C) catastrophe risk charges to capture man-made risks (e.g. Cyber) better.

The Long-term lapse and expense risk sensitivities

The structure of the insurance risk BSCR module will be refined so that the ‘other insurance risk’ submodule will be replaced by new lapse and expense risk submodules. The correlation matrix for aggregating the long-term insurance risk components into the overall long-term ‘insurance risk’ charge will also be modified to reflect this.

Also the Lapse and Expense risk capital charges will be calculated separately by applying a series of specified shocks (rather than using the current factor-based approach).

- The lapse risk module will take the most onerous of lapse up, lapse down and mass lapse shocks, where the shocks are applied to homogeneous business groups. There will be no offsetting between different homogeneous groups. The lapse up and lapse down stresses are a 40% change in lapse rates while the Mass lapse shock is a shock of at least 3 times the best estimate lapse assumption subject to prescribed minimum levels of shock which are determined by the product type.

- The expense risk shock will comprise an increase in the base unit costs (of 6% or 8% depending on the territory of the business) plus a simultaneous increase in future expense inflation (of between 100bps and 300bps depending on the duration of the business).

These changes, which are a refinement on the current factor-based approach, have the potential to impact all life (re)insurance firms and will make the BSCR more risk-sensitive to lapse and expense risks. We expect these changes to lead to a material increase in the insurance risk BSCR for firms with lapse-sensitive product types.

P&C catastrophe risk

It is proposed that the BSCR Catastrophe Risk module be enhanced to include a dedicated man-made catastrophe risk submodule covering Terrorism, Credit and Surety, Marine, and Aviation. This would mean that the BSCR adopts the trend followed by other internationally recognised insurance capital models by explicitly modelling man-made catastrophe risk perils. It would also reduce the need for ad hoc capital adjustments for non-modelled catastrophe perils and would mean that the scenarios are risk-sensitive and so promote good risk management.

Adjustments to the BSCR (Section 6D)

The BMA’s proposals are intended to help insurers better understand where an application for adjustments to the standard BSCR framework may be allowed without requiring full or partial internal model approval.

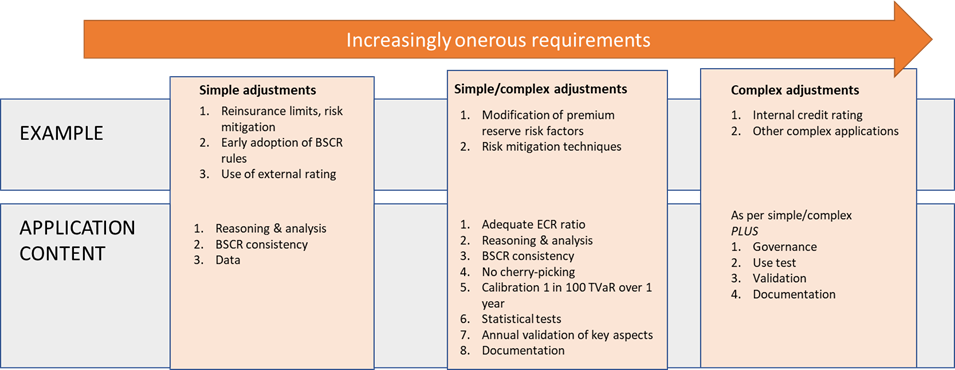

The BMA wants to revise the section 6D regime to allow for a certain pre-defined set of adjustments that fall under one of three different routes which they describe as (1) simple adjustments (2) Simple/complex adjustments and (3) complex adjustments.

These different routes come with increasingly onerous requirements with the simplest applications attracting significantly less onerous requirements than the more complex adjustments for which the requirements approach those required for full or partial internal model applications.

Insurers would need to submit an application pack that demonstrates ongoing compliance with the standards set out under the respective route. For more complex cases the BMA expects insurers to contact them for preliminary discussions prior to submitting an application.

These BMA approvals will continue to be subject to annual regulatory review.

Next steps and how we can help

Firms will need to complete the field-testing template. The field testing requires firms to produce their regulatory balance sheets on three separate bases using year end 2021 data. The three different bases are:

- The unadjusted year-end 2021 balance sheet, ignoring any of the proposed changes set out in the consultation paper;

- The year-end 2021 balance sheet incorporating proposed changes to the Risk Margin and the BSCR but assuming the existing continued treatment for best estimate liabilities (i.e. not including SBA changes); and

- The year-end 2021 balance sheet incorporating all proposed changes including those impacting the SBA changes which will impact the best estimate liabilities for some firms.

Submitting results on these different bases will enable the BMA to systematically identify and quantify the impacts of their proposed changes on individual firms.

In addition to performing the required field-testing, firms will need to:

- Review their existing SBA practice, identifying any areas that might need refinement and the likely impact of these on the Technical Provisions,

- Consider how capital models might need to change to take account of the changes to the BSCR for lapse and expense risks

- Consider the expected impact on the profitability of existing business and how new business pricing might be impacted by the changes to the SBA and capital requirements

- Revisit their business models, considering the likely impact and implications of the enhanced regulatory requirements

- Consider how those required to provide attestation should be supported (e.g. independent review to provide comfort that the requirements are met)

Our team of c.65 actuarial specialists include a number of senior industry figures who have significant experience of dealing with the Matching Adjustment under Solvency II, implementation of the Standard Formula and adaptations (e.g. for Internal Model purpose or company specific parameters) and providing independent validation and assurance of the regulatory balance sheet. We also have significant experience of internal credit ratings for both UK and Bermudan clients and have provided support to understand the implications of regulatory changes on strategy, new business pricing and capital optimisation strategies.

We have worked with all of the UK’s 8 BPA insurers, 9 of the 20 US Pension Risk Transfer firms and a number of Class E Bermudian (re)insurers.

If you would like to discuss any of the content of the BMA’s consultation paper, please contact Dan Diggins or Nick Ford or your usual Hymans Robertson contact in the first instance.

0 comments on this post