Longevity benchmarking insights

25 Oct 2024

Despite daily life returning to normal since the COVID-19 pandemic, insurers and reinsurers continue to face challenges when setting their longevity assumptions due to the uncertainty surrounding the long-term effects of the pandemic. This is in part due to the ever-evolving CMI model, in which the weight given to recent data is a key consideration and is leading to headaches across the industry.

In this blog, we set out some of the high-level takeaways from our 2024 longevity benchmarking survey. There were 18 insurers and 13 reinsurers who took part.

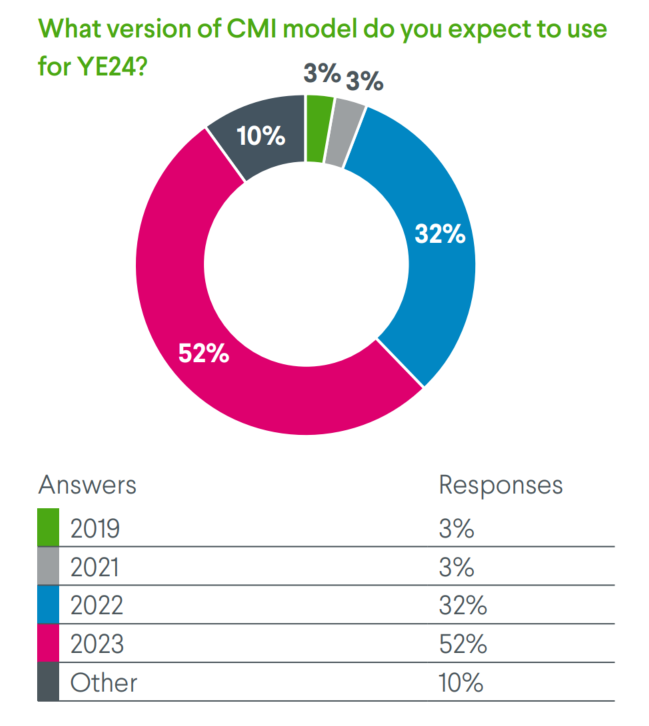

Model version

More participants (52%) are expecting to move to the most recent version of the model (CMI_2023) for their year-end 2024 disclosures than we have seen in recent years.

Allowing for COVID

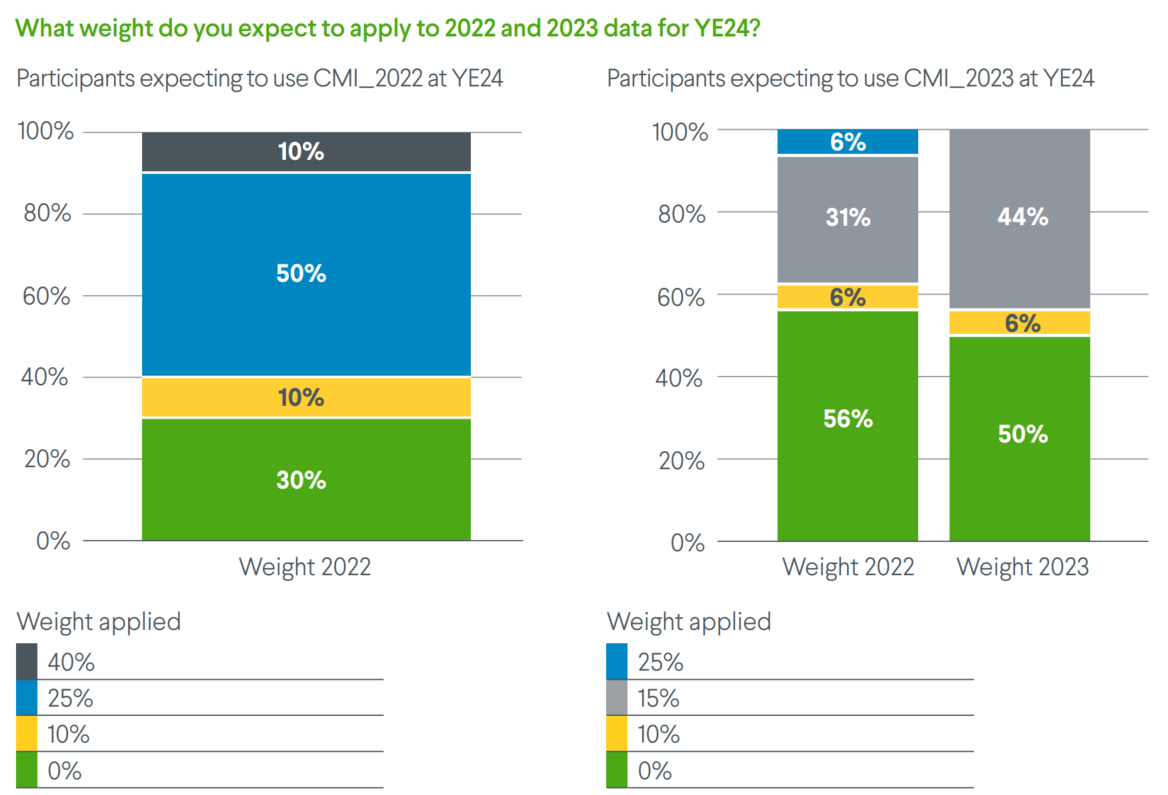

The CMI this year have changed their approach to the default weight parameter which was expected to increase by 25% each year and in CMI_2023 have opted for defaults of 15% weight on both 2022 and 2023 data.

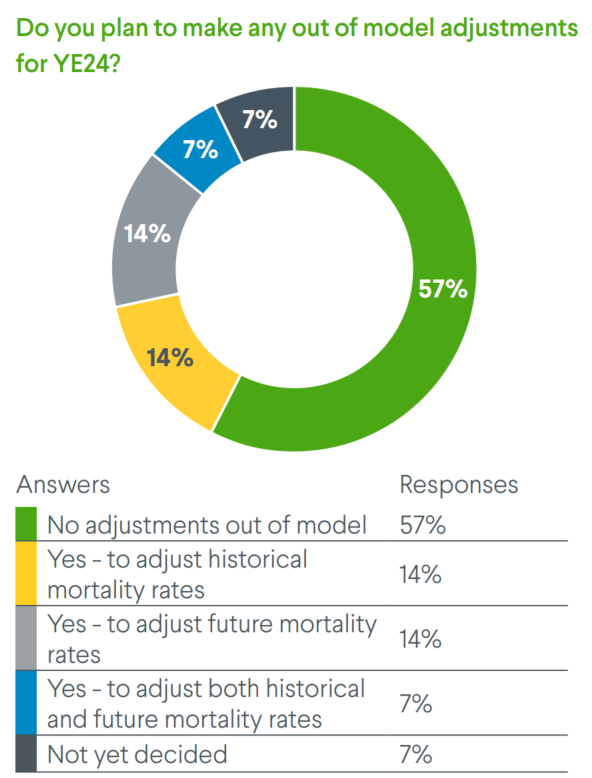

Though some firms use these weight parameters, an increasing proportion of our participants adjust either historic rates, future rates or both outside of the model.

Looking forward to this year-end, most firms using CMI_2022 expect to use 0% or the default 25% weight on 2022 data. More firms moving to CMI_2023 expect to place no weight on the data, instead generally opting for out of model adjustments.

Of those expecting not to place any weight on 2022 and 2023 data using the CMI_2023 model, all are at least considering adjusting for COVID outside of the model. In total, 43% of respondents expect to adjust outside of the model, and this is being done in a variety of ways, with the use of overlays being the most common.

The majority of other parameters of the model remain relatively unchanged from previous years’ surveys.

Overall improvements

It is becoming increasingly difficult for companies to benchmark based on CMI parameterisation alone, not least because of the number of firms adjusting improvements outside of the model. This year, we therefore asked firms to provide improvements at a range of ages from pre-pandemic in 2018 through the next 20 years.

A variety of methods are being used to allow for the pandemic. One approach is for companies to use spikes in their improvement rates to reflect the years of higher mortality seen during the pandemic. This is typically done via an out of model adjustment. Other companies are using the CMI model more heavily and are, therefore, assuming smoother rates.

Looking forward to the CMI_2024 model, early indications are that this is only going to become more challenging. From plugging in some realistic 2024 data to the model, the CMI has shown that the single weight parameter approach reacts strangely and so is exploring other options.

We eagerly await the CMI_2024 consultation, which is due to come out this Autumn, to see what is proposed for the next version of the model with default overlays being one of seven methods being considered. This is an area companies are going to have to spend a lot of time on until we have enough post-COVID data to set assumptions the ‘old way’, using a more data driven approach.

If you wish to discuss this further, please do get in touch with one of the authors or your usual Hymans Robertson contact.

This blog is based upon our understanding of events as at the date of publication. It is a general summary of topical matters and should not be regarded as financial advice. It should not be considered a substitute for professional advice on specific circumstances and objectives. Where this blog refers to legal matters please note that Hymans Robertson LLP is not qualified to provide legal opinion and therefore you may wish to obtain independent legal advice to consider any relevant law and/or regulation. Please read our Terms of Use - Hymans Robertson.

0 comments on this post