Pensions Pandemic

Focusing on the long-term game

01 Sep 2020

2020 has been a very different year to say the least. So much has changed, from the way we shop to the way we work, to the way we have our exams and even to the way we eat (though the last one has been pretty great throughout Monday - Wednesday in August). But one thing that may have changed that perhaps shouldn’t have, is the way we manage our pension.

Indeed, the emergence of COVID-19, its tragic consequences and the resulting economic turmoil is a reminder of just how quickly things can change. For some savers, this has meant changing their pension choices to plug a financial gap right now. This is completely understandable. However, it's important to know how these decisions, which may seem insignificant now, could have longer term implications for their pension.

Using our latest insights from the Hymans Robertson Member Outcomes Tracker1 we can see how members’ retirement outcomes could be impacted by markets and changes in behaviour.

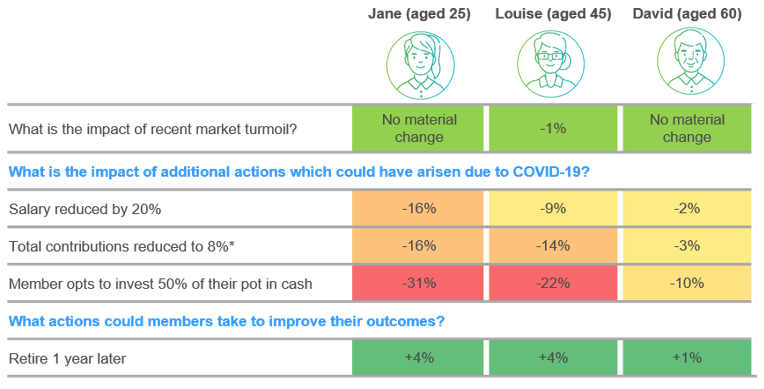

Meet Jane, Louise and David, who are at different stages of their savings journey. The table below shows how their retirement outcomes have been impacted over the course of 2020 and furthermore, the impacts of any behavioural changes following Q1 2020.

What is the impact of recent market turmoil on members’ retirement outcomes?

Considering the impact of recent market turmoil and changes in future investment return expectations, our analysis shows that members’ long-term outcomes have not been materially impacted. However, we know that the potential impact for some members could span beyond purely investment considerations as we consider further below.

What is the potential impact of other factors arising from COVID-19?

Salary reduction

Due to the Government’s Furlough scheme and pay cuts, some members may have faced a 20% reduction in their salary. If this occurred, we can see that Jane, the youngest member in our group, would have been hit the hardest facing a 16% drop in her expected retirement outcome. This is due to the significant drop in the level of her future contributions.

Reduction in total contributions

It is quite possible that members would have reduced their pension contributions due to concerns about their immediate cashflow needs (e.g. this could also be linked to a reduced salary). If our members reduced their contributions to 8% (minimum for Auto-Enrolment), we can see the impact would have been significantly worse for Jane and Louise. Younger members have considerably smaller pots and benefit from the effects of compounding via their contributions.

Knee-jerk investment in cash

The market falls could have caused some concerns for members – with some inclined to move their assets into cash to protect against further falls. In doing so, members would have sacrificed long-term return potential. This effect is illustrated most significantly for Jane due to the dramatic reduction in her expected retirement outcome. David would also see a negative impact but to a lesser extent since he is closer to retirement.

What actions could members take to improve their outcomes?

Defer retirement

Some members may consider deferring their retirement to save more money for retirement and provide more time for their accumulated wealth to grow. This could improve a member’s expected outcome meaningfully.

So, what does this mean going forward?

Of course, in these circumstances some of the impacts described above cannot be helped. But, as Trustees or Governance Committees, it’s important to know how your members have been impacted and whether any potential areas of focus can be identified to aid your communication with different member cohorts.

Although the picture across growth markets has improved in the short-term, the continued threat of COVID-19 still very much remains. So, the need for monitoring the success of your strategy for members seems more crucial now than ever.

This is where our Outcomes Tracker comes in to play – it is easily adaptable for your scheme and your members to show what really counts, the impact on member outcomes and focus on the long-term game.

For more information on the tracker please contact your regular Hymans DC contact or get in touch here.

1 We introduced the Hymans Member Outcomes Tracker in May 2020. A tool which combines our Guided Outcomes and Club Vita technologies to see how members’ retirement outcomes could be impacted by markets and changes in behaviour. .

0 comments on this post