On Demand Valuations

Full quarterly valuations based on bang up-to-date member data.

With today’s pace of change, all schemes, big or small, simple or complex, need a more dynamic, precise and responsive approach to managing funding, risk and cashflows.

Why do we need on-demand valuations?

21st century pension scheme management looks very different to the traditional model. From a funding and investment perspective, the traditional triennial valuation cycle, based on projections of historical membership data, no longer meets the needs of DB pension schemes. What’s more, members’ levels of freedom over their retirement decisions make it harder to predict what options will be chosen. If your valuation data isn’t kept up to date to reflect these settlements as they happen, then your cashflow forecasts could be overstated.

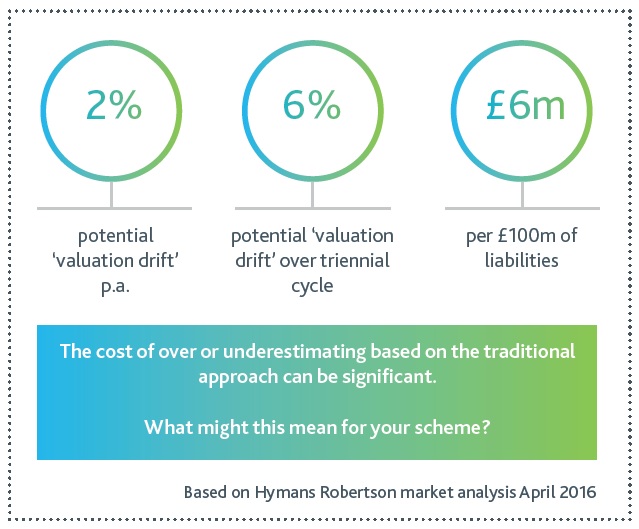

Approximations made in traditional funding projections, coupled with the impact of member data changes, results in ‘valuation drift’. This means trustees cannot be confident in making important funding and investment decisions as they're basing it on potentially misleading funding and risk data.

In a fast-changing world, with scheme benefit changes and member options exercises being undertaken between valuations, it's critical to be able to keep your funding information up to date.

That’s why we’ve developed a transformational approach to valuations. We provide our clients with updated liability, cashflow and risk information, based on up to date member data ‘on demand’ and as a matter of course, every quarter at no extra cost1.

Members’ levels of freedom over their retirement decisions make it harder to predict what options will be chosen. If your valuation data isn’t kept up to date to reflect these settlements as they happen, then your cashflow forecasts could be overstated.

How does it work?

We’ll provide updated liability, cashflow and risk information, based on up to date and accurate member data every quarter1, or scheduled to meet your needs. No need to wait for triennial valuation results. Discussions can happen when needed and you can make decisions confidently based on bang up-to-date data.

What are the benefits?

The benefit of On demand Valutations include:

- confidently acting on de-risking triggers;

- updating LDI portfolios to ensure they remain fully effective;

- closely monitoring the attractiveness of buy-in pricing; and

- making investment and funding strategy decisions at any time, safe in the knowledge of the scheme’s true funding position.

Through our seamless process from on-demand valuations to using 3DANALYTICS, with precise, accurate, up to date data, schemes can make better decisions and achieve more certainty over the future. The result? More stability of cash contributions for sponsors and enhanced security of members’ benefits.

1 Subject to receipt of member data of appropriate quality, provided in a consistent format. For Hymans Robertson TPA clients this service is carried out as standard, at no extra cost to our administration fees.