DC Scheme Structure

Determining the most suitable DC scheme structure or ‘vehicle’ to deliver your objectives can be difficult.

Employers and trustees can be faced with several competing challenges such as reducing risk, improving member experience and reducing costs. So which is the most appropriate scheme structure for your needs?

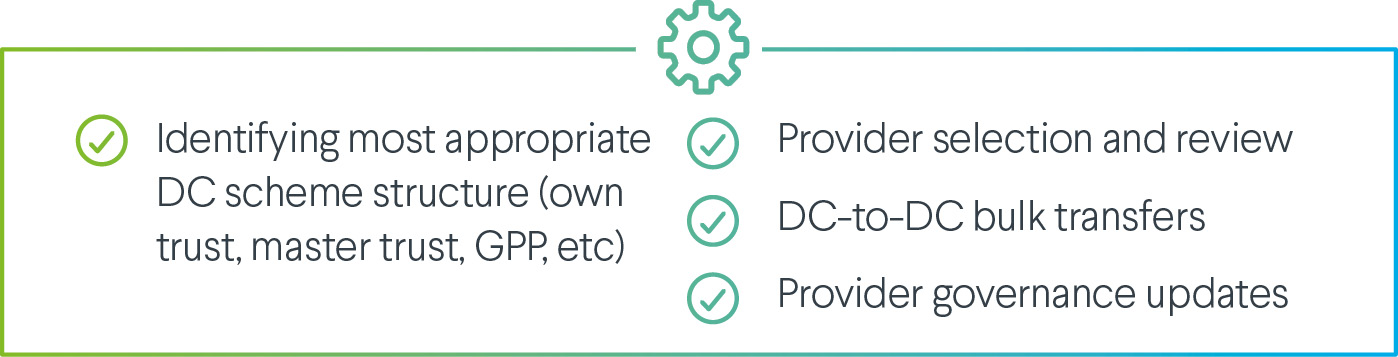

We work with employers and trustees, providing advice across all aspects of DC scheme structure. We take an independent unbiased approach to help our clients decide on the best structure for their needs, whether that be an own trust, master trust or a group personal pension (GPP) arrangement. We believe the answer is never black or white, and we will always search for the right option to suit an employer’s business and member needs, helping to deliver better outcomes.

In addition, through our regular and meaningful engagement with all the major providers, we are able to leverage our relationships to ensure that our clients put in place the best possible provider for their needs at outset and in the future.

Our services include help with:

Innovative digital solutions

Our advice is underpinned by innovative technology and digital expertise. Adapting to an ever more digital world, we have over 200 digital experts ranging from data scientists, modellers, technical architects, developers to UX designers, all dedicated to creating transformative digital solutions.

Our digital first approach makes sure we’re harnessing the latest technologies and agile delivery to meet your needs. Powered by the latest cloud technology, our tools and solutions are best in class, and continually updated to keep up with the latest digital developments.

Our digital solutions evolve all the time. If you have a business challenge you need help with or if you would simply like to talk to one of our experts, please don’t hesitate to get in touch.

Risk sharing - an age old solution to the old age problem

As increasing numbers of DC savers come to retirement in future years it's clear they need help in maximising their income, while managing their savings. The Chancellor’s Mansion House speech put CDC firmly on the agenda as a new risk sharing approach. But there are many flavours of risk sharing available which can be applied to meet the needs of different members.

Master Trust Default Fund Performance Review

In the latest edition of our Master Trust Insights, we assess the impact of Master Trust default fund performance on member outcomes.

Featured Insights

See our latest thinking on the issues impacting defined contributon pension schemes.

Insights

Award-winning advice