FOR UK FINANCIAL ADVISERS

Six months on: the markets amidst COVID-19

23 Oct 2020

It’s safe to say it’s been a challenging six months on every level. But as the dust starts to settle – just a little – on 2020, what should be Financial Advisers’ main focus areas for the year ahead?

Let’s start looking forward by taking a step all the way back to March. The one constant was the extent of the slump world-wide, basically due to the basic shutting down of most of the world’s economies. The subsequent slump was easy to predict – what’s been harder to understand is the potential shape of the recovery. So far, the bounce back has been strong – but I have to wonder why we’re continuing to price the markets as normal when real life hasn’t returned to anything like that state. Uncertainty is the only certainty.

So, with that in mind, let’s take a deeper dive into three of the main asset classes and see what is going on underneath the bonnet.

(click on the image to enlarge)

Equities

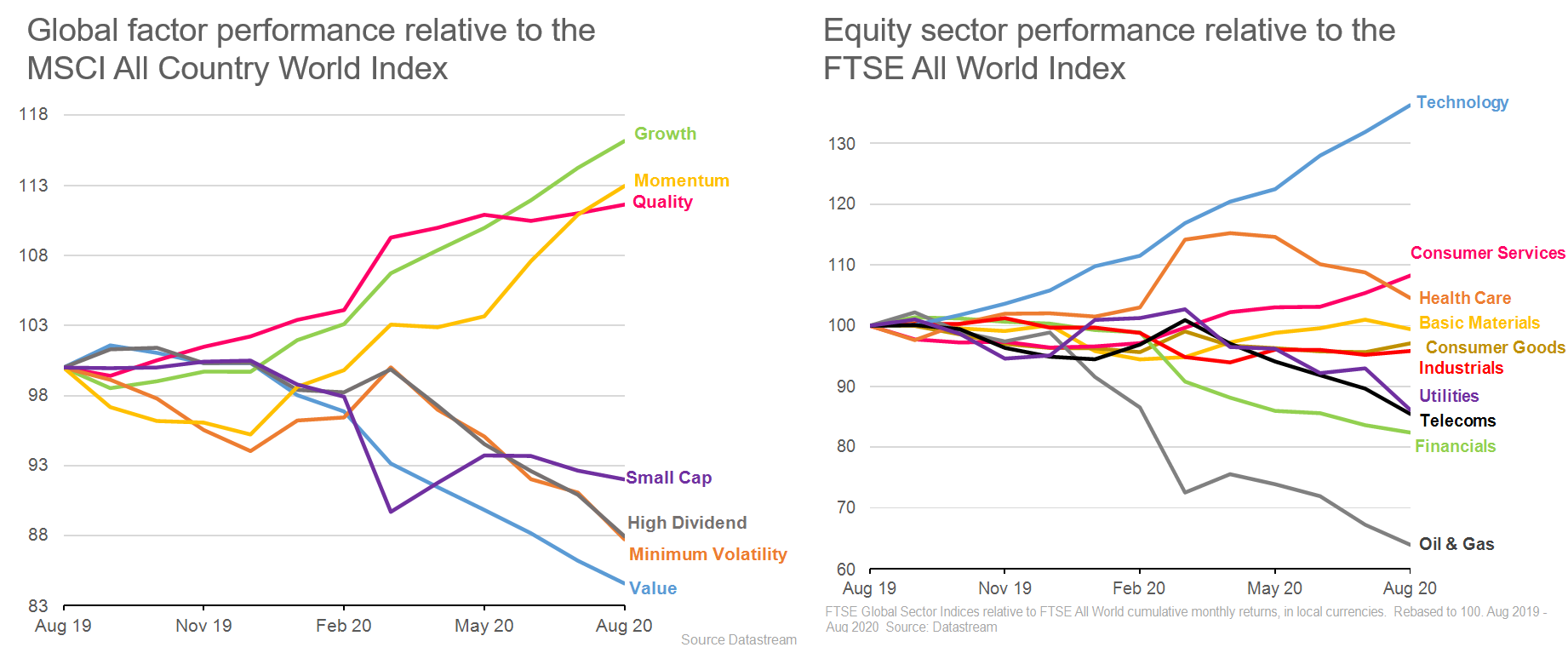

In equities, Q1’s 20% fall was followed by a 28% rise, leaving the global markets in a strong position. The picture is far from uniform though – in fact, while the US has performed well, the UK’s performance was dismal. Variation has been enormous by sector and type too: the so-called ‘value stocks’ (high-dividend or income stocks) have suffered year to date and oil and gas sectors have collapsed, while growth and technology stocks have materially outperformed the market.

The strong US performance was supported by its large allocation to technology. We can see from the sector graph that tech has outstripped everything else, particularly due to the big five FAANG tech companies (Facebook, Amazon, Apple, Netflix and Google).

It’s important to ask the right questions about the FAANG companies. It isn’t about whether they are strong and stable – they are. And even though their collective market capitalisation is bigger than the whole of the UK market, this isn’t a tech bubble situation or risk. They are resilient global organisations that also happen to work particularly well with society’s new way of living. The real question we should be asking ourselves is are they over-valued? Can their price go any higher? Is there any room for growth? Many people are riding both sides of that argument, and the results aren’t yet known.

On the downside, telecoms and utilities are both in negative territory. An unexpected outcome given they don't typically suffer from that level of volatility. So, what went wrong here? While regulated utilities have the protection of consumer use, commercial consumption was essentially turned off during lockdown. And with high valuations, once the market rallies utility stocks don’t go up as much as everything else, so you end up behind. Telecoms are interesting too. Typically, they’re fixed contracts with static revenues, but with millions of people working from home their costs have increased to maintain and invest in their networks to meet the demands of all that streaming. So, the original internet companies aren’t really benefiting from the huge rise in domestic internet use.

(Click on the image to enlarge)

Property

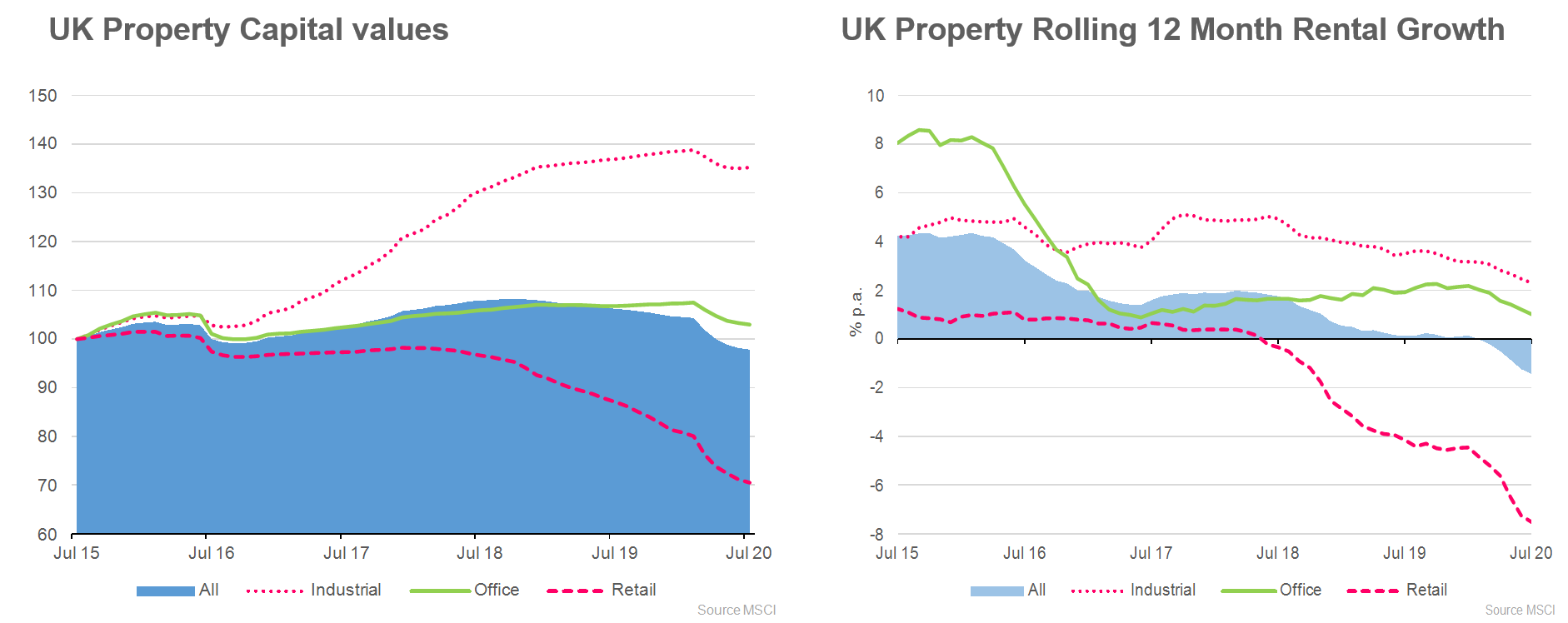

Property is another complex story. We all know it’s been a miserable time for commercial property – that pattern was underway well before the pandemic. But COVID has accelerated the demise of high street retail property.

As well as some struggling performance, there are two other property issues that advisors need to be aware of.

- Firstly, many funds were suspended as valuers struggled to view and price properties and although most funds are now re-open, the pricing issue still causes challenges. New FCA regulations mean funds have to suspend dealing if there is a material uncertainty about a valuation of at least 20% of the value of the scheme’s property. There is the potential that could lead to an entrapment of clients’ money if you’re holding affected funds.

- The second issue is it takes time to buy and sell buildings which means there can be a lag if clients want their money back. To solve this, property funds need to hold a significant cash balance, which can cause a drag we don’t want to see. The FCA are considering introducing notice periods into funds to prevent this issue, but that also means investors need to be aware there could be a delay before money can be accessed.

That said, property brings diversification to investors. But in our models, we choose to use forms of listed property, allowing us to earn income without actually having to buy any real estate. We have to accept returns are more likely to have a short-term correlation with the equity market through this approach, so we also look for real asset exposure through other means, such as infrastructure.

(Click on the image to enlarge)

Fixed interest

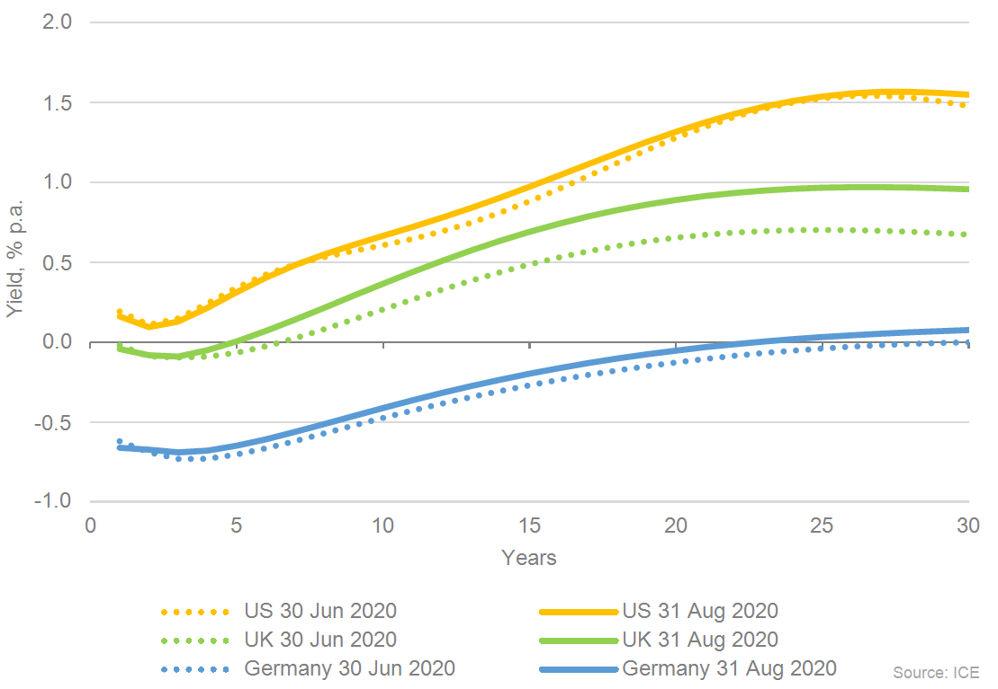

Is there any point in holding cash and bonds in the current low yield environment? They didn’t exactly start the year offering much return and base rates are now down to 0.1%. The yield on ten year gilts is down to 0.3% and on the chart we can see short-dated gilts are being issued at interest rates slightly below zero.

Given the rise in global borrowing from governments, we don’t expect interest rates to rise any time soon – actually, they could go lower. Bizarrely, this could bring positive results from gilts. Taking fees into account though, the annual yield on government bonds and cash is very little and can quickly become negative. There are ways to enhance this return in a model – such as investing a portion of the assets into investment grade bonds.

In cash, many funds invest in very short dated paper. This provides immediate liquidity but virtually no yield. Other cash funds target higher returns by holding longer paper, say debt that’s 3 months to a year out. It’s still highly liquid, but you get a little bit of premium just for holding some risk, so that’s another way to look at enhancing return marginally in the fixed income space

Always remember, the biggest talking point among economists right now is the risk of inflation. If economies, particularly the UK, get moving properly we could see inflation rise so it’s always important to think about protection against that.

Bringing everything together, it’s still impossible to predict what’s going to happen next. As always, we bring our approach to investment strategies back to balance, diversification and discipline. You can’t second-guess outcomes, especially now, so always work towards resilience. We talked about this in a recent webinar, and, as always, don’t hesitate to get in touch if you’d like to talk through any of the points in this blog.

This blog is based upon Hymans Robertson LLP understanding of events as at date of publication. It is designed to be a general summary of topical investment issues, it does not constitute investment advice and is not specific to the circumstances of any particular financial advisory firm.

Please note the value of investments, and income from them, may fall as well as rise. This includes equities, government or corporate bonds, and property, whether held directly or in a pooled or collective investment vehicle. Further, investments in developing or emerging markets may be more volatile and less marketable than in mature markets. Exchange rates may also affect the value of an overseas investment. As a result, an investor may not get back the amount originally invested. Past performance is not necessarily a guide to future performance.

0 comments on this post